When The Mirage changed hands this week, it marked the beginning-of-the-end for its iconic volcano attraction.

The sale also shed more light on a growing, lucrative real estate trend on Las Vegas Boulevard: Casino landlords are collecting hefty rents.

MGM Resorts International announced Monday that it closed its nearly $1.1 billion cash sale of The Mirage’s operations to Hard Rock International, which assumed control of the property as of 6 a.m. that day.

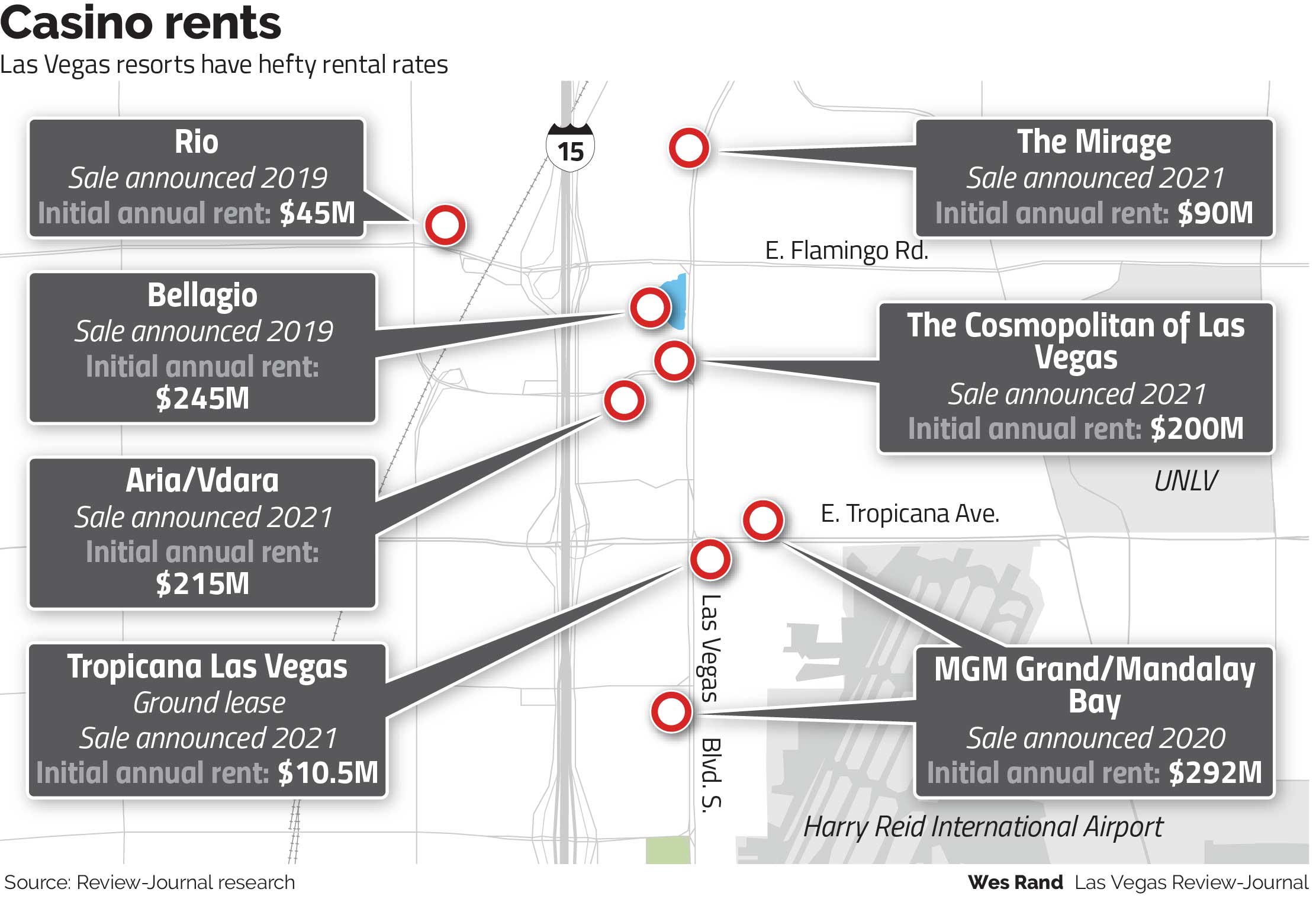

Also Monday, Vici Properties, which owns The Mirage’s real estate, said it entered a lease with Hard Rock that calls for initial annual rent of $90 million.

Real estate ownership along Las Vegas Boulevard has dramatically changed in the past several years, as casino resorts up and down the Strip are now leased to rent-collecting landlords. Vici is now by all appearances the biggest property owner in the famed corridor, boasting 660 acres, as of this spring.

As casino property ownership changed hands, it resulted in little, if any, visible effect for customers. But landlords paid billions of dollars to own the huge hotels along the Strip — and lock sellers into high-priced leases.

Macquarie Capital analyst Chad Beynon said casino operators who sell a property get “immediate funds” they can use to invest in other properties or businesses, or pay down debt.

But, he noted, they are also obligated to pay rental rates that are structured to climb over time.

“It’s a fixed and rising expense,” Beynon said.

It’s not cheap, either.

Caesars Entertainment Inc. said in a regulatory filing that it expected to shell out more than $1 billion in lease payments in 2022. MGM Resorts disclosed that it was required, as of Sept. 30, to make $1.9 billion in “cash rent payments” over the next 12 months.

Don’t feel too bad, though, as MGM in particular has made mountains of money selling its real estate in sale-leaseback deals.

It sold the Bellagio for $4.2 billion in cash to financial giant Blackstone in 2019, and raked in $2.4 billion in cash from the 2020 sale of MGM Grand as part of a deal that also involved Mandalay Bay.

Last year, MGM paid more than $2 billion for full ownership of Aria and Vdara — and then sold the towering resorts to Blackstone for nearly $3.9 billion in cash.

MGM still operates all of those properties.

Vici, a Caesars spinoff, vastly expanded its holdings on the Strip with the $17.2 billion buyout of MGM’s real estate spinoff. As part of the deal, which closed this spring, it acquired several MGM-operated properties along Las Vegas Boulevard including The Mirage, Park MGM, New York-New York, Luxor and Excalibur.

Hard Rock, owned by the Seminole Tribe of Florida, announced in December 2021 that it was buying The Mirage’s operations. It has since outlined plans to gut the resort and expand its casino floor, convention space and theater.

It’s also looking to build a guitar-shaped hotel tower on the site of the outdoor volcano attraction, an idea it first floated a year ago.

It could get some help with The Mirage’s overhaul from its landlord. Vici said Monday it “may fund” Hard Rock’s planned redevelopment of the property, but added specific terms remain under discussion.

Contact Eli Segall at This e-mail address is being protected from spambots. You need JavaScript enabled to view it or 702-383-0342. Follow @eli_segall on Twitter.

| < Prev | Next > |

|---|

Copyright © 2025 ToCasino.net Online Casino. All Rights Reserved. Designed by

Copyright © 2025 ToCasino.net Online Casino. All Rights Reserved. Designed by