Macau’s efforts to reinvent itself with a Hollywood-themed resort and a half-size Eiffel Tower replica has drawn a surge in tourists from beyond China, a sign growth in the world’s largest gaming hub next year will come from leisure players rather than high-stakes Chinese gamblers.

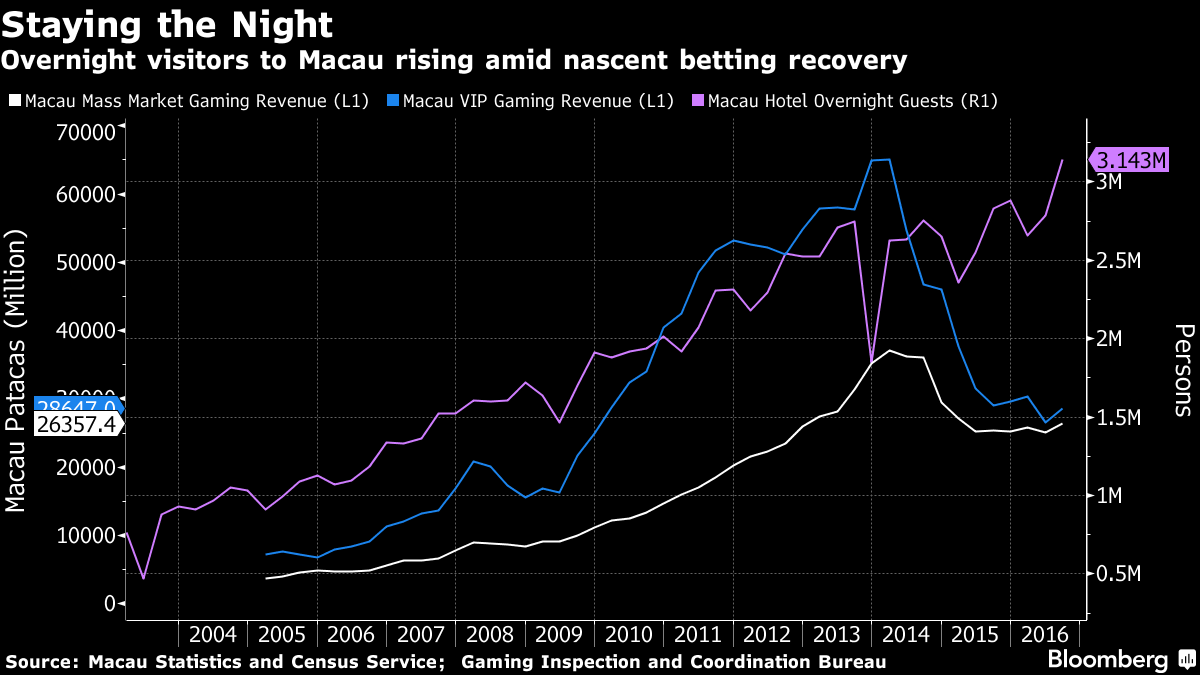

Analysts surveyed by Bloomberg see gambling revenue rising 7 percent in 2017 led by mass market players, after three consecutive years of declines. Visitor numbers from South Korea, Japan, and the U.S. jumped in November, helping offset declining arrivals of mainland Chinese who make up two-thirds of Macau’s 2.6 million visitors in the month, according to the city’s Statistics and Census Service.

Macau’s gaming industry has seen a nascent recovery this summer, as Las Vegas Sands Corp. and Wynn Resorts Ltd. opened tourist-friendly resorts after China’s crackdown on corruption and illegal outflows scared off VIP players. Those efforts intensified in October, when Chinese authorities detained staff of Australia’s Crown Resorts Ltd. to deter its citizens from gambling overseas. The city is at the same time fending off regional challengers such as South Korea and the Philippines.

“There are definitely more reasons to come to Macau now versus two years ago, and that is the key reason why overnight visitation is growing faster than total visitation,” said Nomura Holdings Inc. analyst Richard Huang. As more casinos open in Macau in the coming years, “we expect that to continue drive growth in the mass gaming segment,” he said.

The Macau government is due to announce gross gaming revenue for December as early as Jan. 1. Analysts surveyed by Bloomberg expect full-year gambling receipts of about 222.8 billion patacas ($28 billion), a decrease of 3.5 percent, following declines of 34 percent in 2015 and 2.6 percent in 2014, according to the median of 10 estimates.

Visitors who stay at least a night in Macau, typically tourists, rose 10 percent in November and accounted for 53 percent of total arrivals, while same-day visitors fell 9.7 percent, according to government data. Overnighters are also staying longer, at an average of 2.1 days.

“Without a doubt over past several months, Macau has felt busier than it has in a couple years,” said Grant Govertsen, an analyst at Union Gaming Group LLC. But while Macau’s government is trying to become less reliant on gambling, there’s still a long way to go before it becomes like the Las Vegas Strip, where non-gaming revenue makes up 62 percent, compared with about 6 percent in the Chinese city, he said.

“Does the fact that Macau has an Eiffel Tower now brings extra people to the market? Yes, but their main activity here will still be gaming,” said Govertsen. Las Vegas Sands opened its $2.9 billion casino project in September featuring the Parisian landmark, about a year after Melco Crown Entertainment Ltd. opened its Hollywood-themed Studio City that includes a Batman ride and a Ferris wheel shaped in a figure eight.

MGM China Holdings Ltd. and SJM Holdings Ltd. are also planning to open additional casino resorts in Macau next year.

Macau casino shares have jumped this year in anticipation of the tourist-led recovery, with MGM China surging 52 percent and Galaxy Entertainment Group Ltd. advancing 36 percent in Hong Kong. The Bloomberg Intelligence Macau gaming index gained 27 percent this year, outperforming the 0.7 percent drop in Hong Kong’s benchmark Hang Seng Index.

Still, Galaxy’s billionaire chairman Lui Che-Woo said in an interview in September it was too early to say the worst is over for Macau, preferring to wait for more-sustained growth, backed by mainstream gamblers rather than VIPs.

Meanwhile, Melco Crown Chairman Lawrence Ho is setting his sights beyond Macau, as the fight for market share in the former Portuguese enclave heats up. The billionaire is taking greater control of Melco Crown after former co-chairman James Packer’ Crown Resorts Ltd. slashed its stake in the Macau casino operator.

“We are in a recovery. That recovery is not going to be the same as the recovery during the global financial crisis,” Ho said in an interview last month, referring to Macau. “This time around, it’s different. It’s going to be more of a natural recovery.”

— With assistance by Rachel Chang

| < Prev | Next > |

|---|

Copyright © 2025 ToCasino.net Online Casino. All Rights Reserved. Designed by

Copyright © 2025 ToCasino.net Online Casino. All Rights Reserved. Designed by